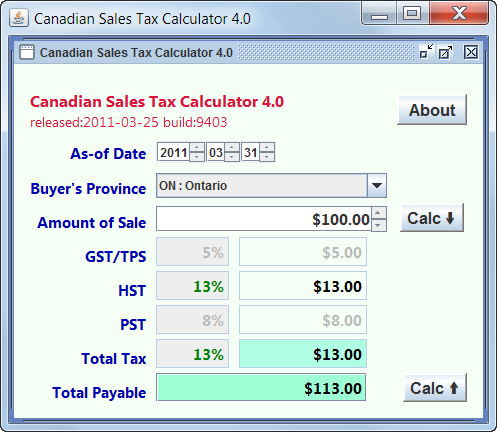

ontario ca sales tax calculator

Amount without sales tax x HST rate100 Amount of HST in Ontario. This includes the rates on the state county city and special levels.

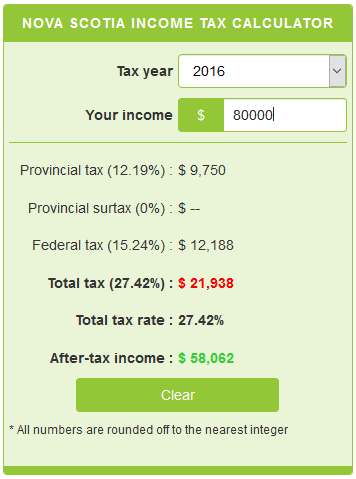

Nova Scotia Income Tax Calculator Calculatorscanada Ca

Find list price and tax percentage.

. Sales Taxes in Ontario. Income Tax Calculator Ontario 2021. Formula for calculating HST in Ontario.

91758 91761 and 91764. The County sales tax rate is. 3 beds 2 baths 1039 sq.

How to Calculate Sales Tax. The current total local sales tax rate in Ontario CA is 7750. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Average Local State Sales Tax. The Ontario California sales tax rate of 775 applies to the following three zip codes.

Multiply the price of your item or service by the tax rate. Maximum Possible Sales Tax. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

Did South Dakota v. The second tab lets you calculate the taxes from a grand total including tax and gives you the subtotal before tax. Located at the Creekside communityn in the City of Onta.

An 8 provincial. The harmonized sales tax HST which is administered by the Canada Revenue Agency CRA is composed of a federal portion at 5 and a provincial portion of 8. 1788 rows California Department of Tax and Fee Administration Cities Counties and Tax Rates.

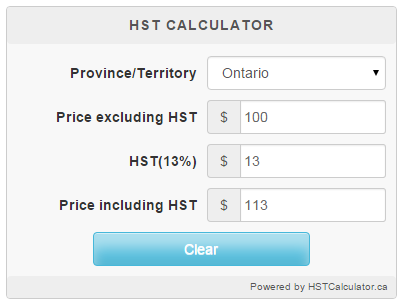

Useful for figuring out sales taxes if you sell products with tax included or if you want to extract tax amounts from grand totals. 100 13 HST 113 total. There are approximately 82703 people living in the Ontario area.

The OTB is the combined payment of the Ontario energy and property tax credit the Northern Ontario energy credit and the Ontario sales tax creditThe annual OTB entitlement is usually divided by 12 and the payments are issued on the 10th of. Within Ontario there are around 3 zip codes. 5 Federal part and 8 Provincial Part.

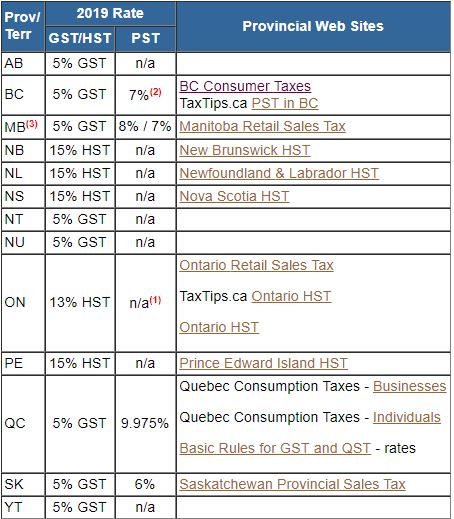

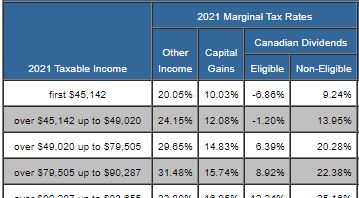

Although the HST replaced the federal goods and services tax GST and the retail. The amount of taxable income that applies to the first tax bracket at 505 is increasing from 44740 to 45142. Sales taxes in Ontario where changed in 2010 then instead of GST and PST was introduced Harmonized sales tax HST.

3881 Antelope Creek Dr Ontario CA 91761 575000 MLS CV22155118 Beautiful One Story Home. On July 1st 2010 HST Harmonized Sales. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

The HST is made up of two components. Current 2022 HST rate in Ontario province is 13. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Ontario CA.

An alternative sales tax rate of 9 applies in the tax region Montclair which appertains to zip code 91762. Where the supply is made learn about the place of supply rules. Sales Tax Breakdown For Ontario Canada.

Who the supply is made to to learn about who may not pay the GSTHST. History of sales taxes in Ontario. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund.

The Ontario Basic Personal Amount was 10783 in 2020. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. The HST is applied to most goods and services although there are some categories that are exempt or rebated from the HST.

To calculate the total amount and sales taxes from a. Sales tax in Ontario. Wayfair Inc affect California.

Ontario is one of the provinces in Canada that charges a Harmonized Sales Tax HST of 13. For 2021 the basic personal amount is increasing to 10880. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

The California sales tax rate is currently. Maximum Local Sales Tax. Type of supply learn about what supplies are taxable or not.

The second tax bracket at 915 is increasing to an upper range of 90287 from the previous 89482. The Ontario sales tax rate is. California State Sales Tax.

Harmonized Sales Tax HST in Ontario What is the current 2022 HST rate in Ontario. Divide tax percentage by 100 to get tax rate as a decimal. Ontario ca sales tax calculator Wednesday February 23 2022 Edit.

This is the total of state county and city sales tax rates. Ontario is located within San Bernardino County California. Sales Tax Calculator Sales Tax Table.

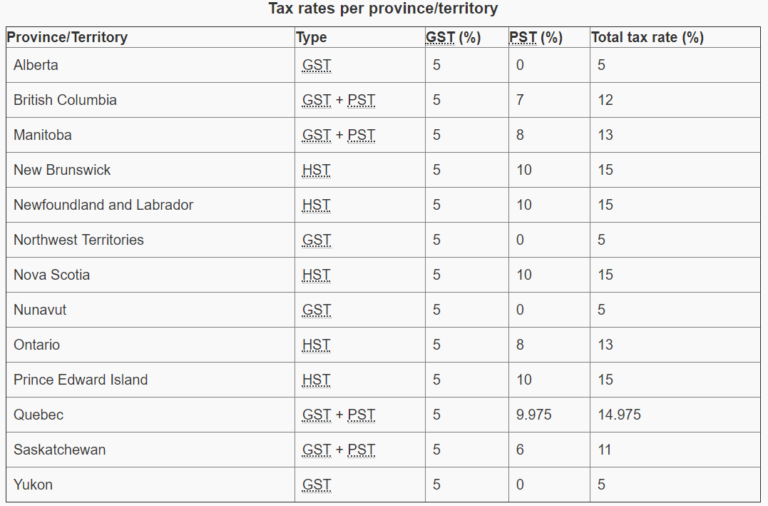

14 rows The following table provides the GST and HST provincial rates since July 1 2010. The HST was adopted in Ontario on July 1st 2010. The December 2020 total local sales tax rate was also 7750.

The minimum combined 2022 sales tax rate for Ontario California is. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Amount without sales tax HST amount Total amount with sales taxes.

The rate you will charge depends on different factors see. Here is an example of how Ontario applies sales tax. Then use this number in the multiplication process.

The average cumulative sales tax rate in Ontario California is 775. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Paid Ontario property tax for the year.

Ontario Hst Calculator Hstcalculator Ca

Gst Calculator Goods And Services Tax Calculation

Taxtips Ca 2021 Sales Tax Rates Pst Gst Hst

Taxtips Ca 2019 Sales Tax Rates For Pst Gst And Hst In Each Province

Pst Calculator Calculatorscanada Ca

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

Ontario Income Tax Calculator Wowa Ca

Income Tax Calculator Calculatorscanada Ca

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

Ontario Income Tax Calculator Calculatorscanada Ca

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

British Columbia Gst Calculator Gstcalculator Ca

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions